LIMITED LIABILITY PARTNERSHIP ( LLP ) :

Limited Liability Partnership (LLP) is a type of partnership where the liability of Partners is limited with appeasement advantages to carry on the business across the country in gratification environment….

Register A LLP in India for Just Rs 8499/- ( Inclusive of Government Fees. No Hidden Charges ) & Get a Unlimited Page Dynamic Website with Server worth Rs 30,000 for FREE.

With over

Over 50,000 Members cannot be wrong in Choosing Smart Business Solutions, Smart Business Solutions is the right choice for you! Simply put, its the

most complete and trusted consultant in India.Our rate are lowest in India, that our guarantee, and the best part is we have a

Post paid plan where you pay only after you get the service

Let’s discuss its Advantages and disadvantages:

Advantages of Limited Liability Partnership ( LLP ):

- This is a type of business MODEL which take its existence with Legalized Agreement i.e. LLP Agreement.

- One can work in gratification environment as joint liability due to other partner’s wrongful or misconduct will not harm any individual partner if not in default.

- More flexibility and less compliance in compare to other business model.

- Simple registration procedure without any minimum requirement of capital and on restriction on maximum limit of partners.

- Easy ENTRY and Exit for partners.

- Limited Liability Partnership is a juristic person and can be sued for its name and sued by others, partners are relaxed from this end.

- If in case of fraud partners personal assets will be fetched to settle the accounts of LLP.

- Limited Liability Partnership agreement is not mandatory but in absence of LLP the mutual rights and liabilities will be decided as per SCHEDULE I of LLP Act.

Disadvantages:

- LLP will be in danger on the act of one partner without obtaining the consent of other partners.

- Investment not allowed by public.

- As we know LLP is a mixture Model of business so compliance with rules and regulation is on higher note.

- Winding up is a major issue in case of Limited Liability Partnership (LLP) because of its very lengthy and expensive procedure.

IMPORTANT

FORMATION OF LLP :

- Two or more person can form an Limited Liability Partnership (LLP ).

WHO CAN BECOME PARTNERS IN LLP ?

- Limited Company

- Foreign Company

- A LLP

- A foreign LLP

- A NON- Resident can be a partner in Limited Liability Partnership (LLP).

DOCUMENTS:

- MEMORANDUM

- AGREEMENT (LLP) Same as AOA.

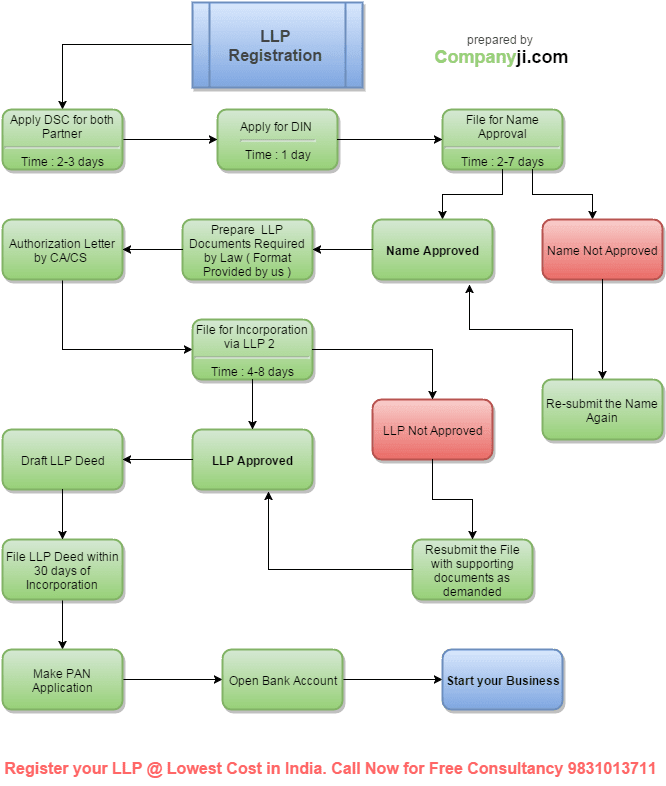

PROCEDURE:

- Decide Partners and Designated Partners.

- Obtain DIN and DSC.

- Name availability

- Drafting

- Filing of incorporation Forms

- Certificate of Incorporation.

ACCOUNTS:

- Books of accounts shall be prepared and maintain and required to submit a statement of accounts and solvency within 30days from the end of 6months of the financial year.

- Within 60days from the end of financial year required to file annual return.

- Mandatory Auditing of Books of Accounts if the turnover exceeds 40lakhs or contribution exceeds 25lakhs.

- Revised Schedule not applies on the Limited Liability Partnership as it is Body Corporate not a company.

IMPLICATION OF TAX PROVISIONS:

- In relation to Tax Provision Limited Liability Partnership = Partnership.

- Limited Liability Partnership ( LLP ) is liable for making tax payment.

- Remuneration Deduction allowed in the hand of LLP u/s 40(b)

- Remuneration to partners will be treated for tax in the heads of “INCOME and PROFESSION”

- Share of profit of Partners is exempted under section 10(2A)

- Benefit in relation to Presumptive taxation is not provided to Limited Liability Partnership ( LLP).

- For Service Tax LLP is Partnership.

Leave A Comment