Loan to Directors u/s 185 as per Companies Act 2013

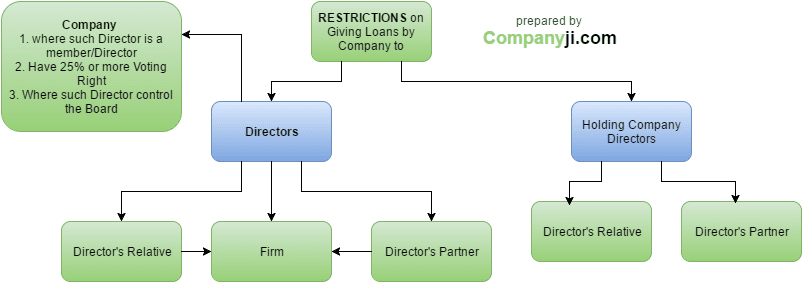

No company shall advance loan (directly or indirectly) to –

- Directors,

- Any person in whom directors are interested,

- Or provide security in connection with loan taken by directors or other person.

Advances and share application money not considered as loan.

‘Any person in whom directors are interested’ means:-

- Any firm in which director is relative or partner,

- Private company in which director is member or director,

- Where 25% or more of voting power is exercised or controlled by director at an AGM,

- Directors of holding company or lending company or partners or relatives of the director.

Company to maintain record of loans in form MBP2. The entries to be signed and authenticated by the CS of the company or any other authorized person by board.

Exception:-

- Loan given to MANAGING DIRECTOR OR WHOLE TIME DIRECTOR as-

- A scheme of service extended by company to all employees, or

- Scheme approved by members at general meeting by passing special resolution.

- A company which in ordinary course of business provides loans to directors or unrelated parties and rate of interest is not less than the rate of interest charged by RBI.

Penalty for contravention:-

- For company- Minimum- 5lacs to Maximum- 25 lacs.

- For receiver- Imprisonment up to 6 months, or

Fine: minimum-5 lacs to maximum-25 lacs, or

Both.

Loans u/s 186

The Act provides that inter-corporate investments not to be made through more than two layers of investment companies. As Company shall make investment through not more than two layers of investment companies. No company can directly or indirectly-

- any loan to any person or body corporate,

- give guarantee or provide security in relation to loan given,

- Acquire by way of subscription or purchase or other wise of securities of any other body corporate.

Excluding-

- 60% of paid up share capital , reserves and securities premium, or

- 100% of free reserves and securities premium.

Whichever is higher.

Approval and formalities-

- No investment can be made without passing a unanimous board resolution and prior approval of financial institutions where loan is subsisting. In case where the above limit is not exceeded and there is no default in payment or repayment of loan or interest.

- If the above limit is exceeded prior Special Resolution in general meeting is required to be passed. The company is required to disclose the details of loans, investments, guarantee in financial statements.

- No company which is in default of repayment of deposit shall give loan/guarantee till the default is subsisting.

- Rate of interest shall be more than prevailing yield of 1yr, 3yr, 5yr etc.

- Every Company to maintain a register which shall contain particulars of loan or guarantee given or security provided or investment made.

Exception:-

- Loan/guarantee/security provided by banking/insurance/housing finance company in ordinary course of business or engaged in business of financing or providing infrastructure facility.

- Any acquisition made by NBFC whose principal business is acquisition of shares.

Penalty:-

For company- minimum-25000 to maximum-5lacs

For officers – imprisonment extending up to 2 yrs. and

Fine- minimum-25000 to maximum- 1lac.

Leave A Comment